The announcement by The Australian Prudential Regulation Authority (APRA) regarding the change on the assessment rate from 2.5 % p.a to 3.0% p.a. has been the talk of the town lately.

This new update has been circulating everywhere, over on blogs, social media and newsletters.

According to APRA’s website, the increase in the serviceability buffer rate was made to counter the rising risks of home lending.

To quote Mr. Byres, “In taking action, APRA is focused on ensuring the financial system remains safe, and that banks are lending to borrowers who can afford the level of debt they are taking on – both today and into the future.” And what does it look like?

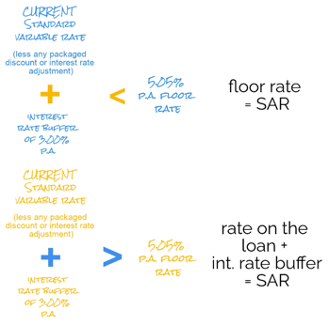

For new and existing consumer mortgage products, the interest rate buffer and floor rate are considered in the calculation of the monthly mortgage repayment/commitment and the interest rate applied is the Serviceability Assessment Rate (SAR).

So why is APRA suddenly announcing this? They believed that with the lockdown lifted, and expectations that the economy will bounce back, APRA considers that the balance of risks has shifted, such that a timely adjustment to serviceability standards is now warranted.

Worried about how this will affect you and not sure how to move forward? Don’t hesitate to visit our website, to know more on how we can assist you. You may also talk to us and BOOK a FREE CALL here.